What does sustainability mean?

- rachelratty

- Jul 5, 2023

- 2 min read

Updated: Nov 12, 2024

A key issue facing social housing landlords today is how to improve the quality of existing housing stock in a way that is environmentally, socially and economically viable, and sustainable, within the resources available to the landlord.

Energy efficiency and zero net carbon criteria are (as they should be) now at the heart of any sustainability agenda and social housing professionals are fully engaged in pioneering responses to environmental responsibilities alongside their fiscal and social ones, whether it be for new build projects or on-going property maintenance.

With a mature understanding of environmental agendas, organisations are aware of how the sustainability agenda impacts their social housing stock, but does the current approach fully address all of the social/strategic and economic aspects of sustainability?

To date it has been difficult to see sustainability fitting into a joined up environmental, social and economic agenda, when aspects of them tend to be managed as isolated agendas. Also, the meaning of sustainability can be unclear and ill-defined within single organisations as well as across the sector, reducing its impact. This may well be because of the vast range of improvement criteria that need to be considered and assessed holistically during stock investments.

Most critically, how can all the relevant criteria be integrated into a decision-support model that is robust and defendable?

Taking a multi-criterion approach

Two expert solutions - combined

Our solution is unique.

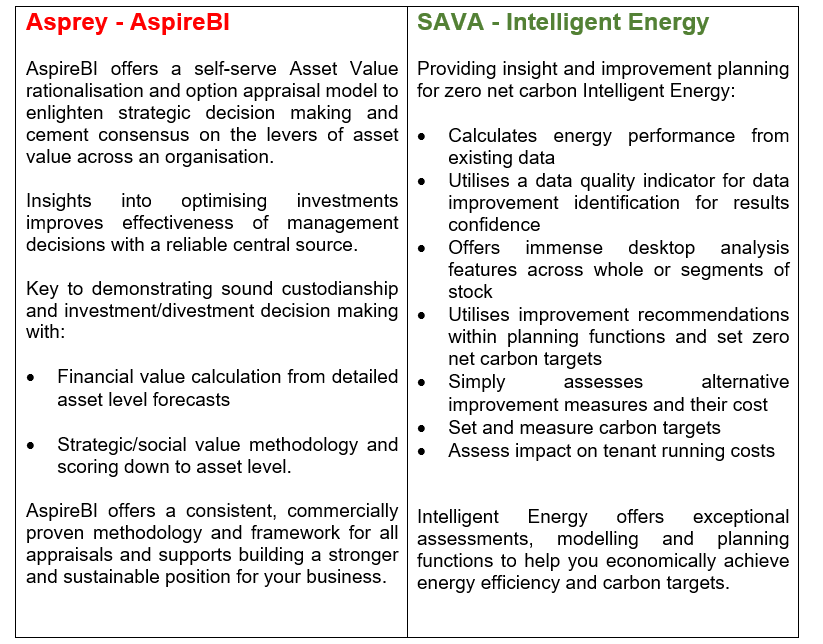

Working with our energy expert partners Sava, we offer our integrated combination of two immensely powerful, best of breed specialist business intelligence products that enables our clients to take a holistic approach to sustainability modelling, fully addressing environmental, social, strategic, and economic factors when optimising the deployment of available resources.

Delivering self-serve asset value rationalisation and investment option appraisal, with integrated energy and commercial sustainability modelling.

Key to demonstrating sound custodianship and intelligent investment decision-making with demonstrable commitment to social and environmental factors.

Features

Financial value calculation (NPV) from detailed asset level forecasts

Strategic value methodology and modelling down to asset level

Analyse energy data simply, to detailed levels

Robust financial and strategic evaluation for investment/divestment decisions

Model New build, Rent Change, Refurbishment, and other scenarios

Harvests information to determine holistic values and their drivers

Easy to use, commercially proven solution that simplifies the complex

Helps turn insights into action and help speed up decision-making

Offers a consistent methodology and framework for future appraisals

Available as self-serve or via managed services

Benefits

Optimise investments & returns

Enlighten and enhance strategic decision making

Improve stock performance against multiple factors and objectives

Build a stronger and sustainable portfolio and business

Shares and cements asset value consensus across an organisation

Reduce management effort with sound, prompt shared knowledge

Minimises subjectivity and identifies investment worthiness, expediting decision-making processes

Initiates continuous improvement and measurable results of interventions

Eliminate repeated and expensive third-party appraisal services

Contact us now to learn more: info@aspreysolutions.co.uk

Comments